Sunflower MLS Home Sales Fell in March

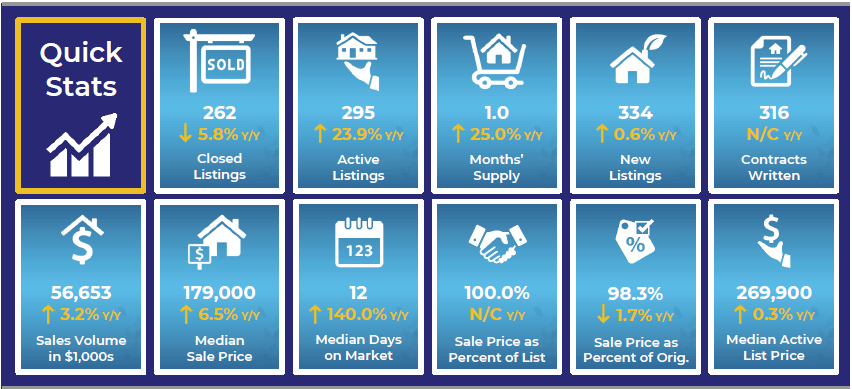

Total home sales in the Sunflower multiple listing service fell last month to 262 units, compared to 278 units in March 2023. Total sales volume was $56.7 million, up

from a year earlier. The median sale price in March was $179,000, up from $168,050 a year earlier. Homes that sold in March were typically on the market for 12 days and sold for 100.0% of their list prices.

Sunflower MLS Active Listings Up at end of March

The total number of active listings in the Sunflower multiple listing service at the end of March was 295 units, up from 238 at the same point in 2023. This represents a 1.0 months' supply of homes available for sale. The median list price of homes on the market at the end of March was $269,900. During March, a total of 316 contracts were written, the same number as were written in February 2023. At the end of the month, there were 336 contracts still pending.

Questions?

For questions and/or comments, please contact:

Denise Humphrey

Association Executive

785-267-3215

* Please contact us for archived statistics past 2022.